Why You Have 3 Credit Scores—and Which One Lenders Use

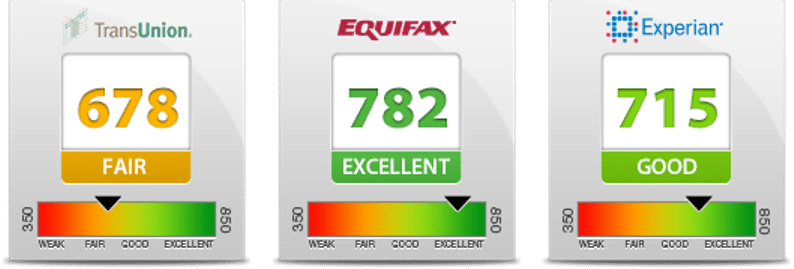

You just checked your credit and saw three different credit scores. So which one is right?

It’s a common question, and the answer might surprise you. Your credit scores can vary between Equifax, Experian, and TransUnion—and that doesn’t necessarily mean something is wrong.

Each credit bureau collects information differently, and not every lender reports to all three credit bureaus. On top of that, they might use different credit scoring models or update account information at different times.

In this article, we’ll explain the main reasons your credit scores don’t match, how each credit bureau builds your credit file, and what those differences actually mean when it comes to borrowing money.

Why Your Credit Scores May Vary Between the Credit Bureaus

Even though all three credit bureaus look at your credit history, they’re not always working with the same data—or the same credit scoring formulas.

Not All Creditors Report to All Three Credit Bureaus

Some lenders only report account activity to one or two credit bureaus, not all three. That means a loan or credit card could appear on your Equifax credit report but be missing from your Experian or TransUnion credit report. With incomplete data, each credit bureau may calculate a different credit score.

Timing of Updates Can Differ

Creditors send updates to credit bureaus at different times. One credit report might show a recent payment, while another hasn’t been updated yet. This timing gap can cause temporary differences in your credit scores—especially if your balances or credit limits changed recently.

Each Credit Bureau May Use a Different Credit Scoring Model

Credit scores are based on formulas called credit scoring models. The most common are FICO and VantageScore, but even within those categories, there are different versions—like FICO Score 8 or FICO Score 9. On top of that, each credit bureau might use a different model depending on the lender’s request. That’s why your credit score from Equifax may not match the one from Experian or TransUnion.

How Equifax, Experian & TransUnion Collect Data

Credit bureaus don’t gather data the same way, and that’s part of why your credit reports—and credit scores—can look different.

Data Sources and Reporting Practices

Each credit bureau builds your credit report using data from lenders, collection agencies, and public records. But they don’t receive the same information from every source. Some lenders may skip a credit bureau altogether, while others might report different details to each one. This can lead to differences in how accounts are displayed and how complete each credit report is.

Errors or Omissions on One Credit Report

Sometimes, the issue isn’t timing or reporting—it’s a mistake. One credit bureau might show a late payment that was actually made on time, or list a balance that’s already been paid off. Common issues include:

- Duplicate accounts – One account may be listed more than once with different statuses

- Outdated balances – Old or incorrect balances can inflate your credit usage

- Wrong dates or statuses – A payment could be marked late when it wasn’t

These types of errors can impact your credit score, especially if they appear on only one credit report.

Do These Credit Score Differences Matter?

Small differences between credit scores are normal. But in some cases, a bigger gap can point to a deeper issue.

Lenders Typically Use One Credit Score, Not All Three

Most lenders don’t average your credit scores. They usually pull one credit score from one credit bureau. For example, an auto lender might check your TransUnion credit score, while a credit card issuer looks at your Experian credit report. Mortgage lenders are the exception—they often use a combined report that includes all three credit scores, sometimes called a tri-merge report.

Large Score Gaps Could Signal a Problem

If your credit scores vary by more than 20 or 30 points, it’s worth taking a closer look. Big differences can mean:

- One credit report has missing accounts

- There’s outdated information still affecting a score

- A potential error, or even identity theft, is affecting one credit bureau

When that happens, you’ll want to review all three credit reports and make sure the data is accurate.

How to Check and Compare Your Credit Scores Accurately

If your credit scores don’t match, the first step is to check what’s actually in your credit reports. The differences usually come down to what is being reported—and where.

Where to Get Your Credit Scores and Credit Reports

You can request a free credit report from each credit bureau once a week at AnnualCreditReport.com. This is the official site authorized by federal law.

To access your credit scores, consider these options:

- MyFICO – Provides credit scores based on multiple versions of the FICO credit scoring model

- Experian – Offers daily access to your Experian credit report and credit score

- Credit Karma – Shows your credit scores based on your TransUnion and Equifax credit reports

- Banks and credit card issuers – Many now offer free credit scores through online dashboards or mobile apps

Compare Credit Reports Side-by-Side

After retrieving your credit reports, review them together to spot differences. Focus on these areas:

- Payment history – Check for any missed or late payments that appear on one credit report but not the others

- Account balances and limits – Look for inconsistent balances that could affect your credit utilization

- Hard inquiries – See which credit bureau shows recent applications for credit

- Collections or public records – Verify that any negative items are reported accurately across all credit reports

What You Can Do If One Credit Score Seems Off

If one credit score looks significantly lower than the others, it could be a sign that something’s missing or incorrect on that credit report.

Dispute Errors with the Credit Bureau

If you find incorrect information on your credit report, you have the right to dispute it. Here’s how:

- Identify the inaccurate item

- File a dispute directly with the credit bureau that reported it—online, by mail, or by phone

- Include documentation that supports your claim

The credit bureau must investigate and respond within 30 days. If the error is confirmed, they are required to update or remove the item.

Contact the Creditor Directly

If the issue is coming from incorrect data submitted by a lender—like a wrong balance or a payment marked late—you can also contact the creditor. Ask them to correct the information with the credit bureau that has the error. This can sometimes be faster than waiting for the dispute process to play out.

Consider Hiring a Credit Repair Company to Help

If you’re feeling stuck or overwhelmed, working with credit repair experts could make the process easier. These services work on your behalf to review your credit reports, identify errors, and handle the dispute process. Look for companies with strong customer reviews, transparent pricing, and a proven track record—not ones that make promises they can’t keep.

Final Thoughts

Minor differences between credit scores are completely normal. They usually come down to timing, reporting gaps, or credit scoring models.

But it’s still a good idea to monitor all three credit reports regularly. Spotting discrepancies early can help you fix issues before they affect your ability to qualify for credit. If you notice inaccurate information or need help improving your credit scores, consider using a credit monitoring service or a reputable credit repair company.

Frequently Asked Questions

Why does my credit score change from month to month?

Your credit score can change as new information is added to your credit report. Common reasons include changes in your credit card balances, new accounts, missed payments, or hard inquiries from credit applications. Even paying off a large balance or increasing your credit limit can cause your credit score to shift slightly.

Do paid-off accounts affect my credit scores differently at each credit bureau?

They can. If a paid-off account is reported inconsistently or at different times to each credit bureau, it might impact your credit scores unevenly. One credit bureau may reflect the zero balance, while another still shows a balance, which affects your credit utilization and, in turn, your credit score.

How long do credit bureaus keep negative information on my credit report?

Most negative items stay on your credit report for seven years. This includes late payments, collections, and charge-offs. More serious issues, like bankruptcies, can remain for up to ten years. Each credit bureau follows the same general reporting timelines, but an item could fall off one credit report before the others due to slight processing differences.

Can I request which credit bureau a lender uses?

Not usually. Most lenders have preferred credit bureaus they work with and won’t allow you to choose which one they pull from. However, you can ask before applying, and some lenders may tell you which credit bureau they typically use. This can be helpful if you know one of your credit reports is stronger than the others.